Fortunately, a solution is not complicated.

Paying state taxes while working remotely code#

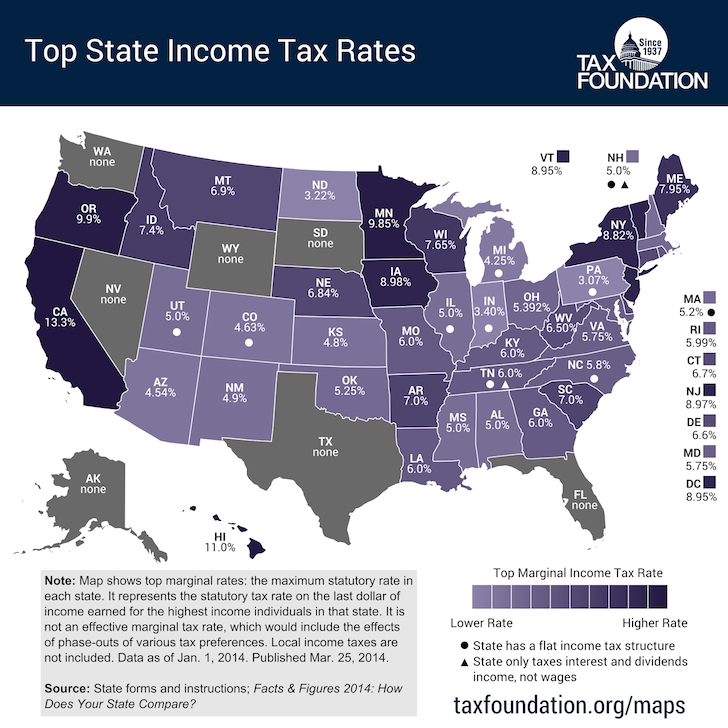

Unfortunately, the First State comes in as the 50th state out of 50 on the ROAM Index, ranking as the single worst state for how its tax code treats remote and mobile workers.įor a state that has worked to cultivate a reputation for being business-friendly, Delaware is doing real damage to its reputation over comparatively meager amounts of revenue. And when taxpayers don’t simply ignore this obligation, it can result in taxpayers and businesses avoiding short trips to Delaware so as not to create new paperwork burdens.Ī new report, the Remote Obligations and MobilityIndex, ranks each of the 50 states on how their tax codes affect remote and mobile workers.

The lack of filing or withholding thresholds means that taxpayers and businesses spending time in Delaware could be subjected to unnecessary tax filing and withholding obligations over just a couple days of work. Similarly, Delaware offers no withholding threshold either, meaning that businesses are also liable for withholding Delaware state income taxes on behalf of their employees from the first day that employee earns income in Delaware. More: Stressed and unhappy about work? Micro-breaks can help you regain focus and energy. Note that “earning income in Delaware” can represent anything from being a contractor who does a job in-state to a remote worker working from a family member’s house while visiting. Delaware offers no filing threshold whatsoever, meaning that a taxpayer is liable for filing an income tax return from the very first day that they earn income in Delaware. That’s not the only reason that Delaware is best avoided by nonresident taxpayers, however. Delaware’s rule therefore catches nonresident taxpayers in a tug-of-war between their home state’s revenue department and Delaware’s - an unenviable position. But if Delaware claims that a remote worker who neither lives nor works in Delaware owes taxes, a home state is not often inclined to provide that credit.

Under normal circumstances, a taxpayer's home state allows them to claim a credit on their tax return for taxes paid to another state. But even worse, it can set taxpayers up for double taxation. This rule, which only three other states enforce, is illogical, confusing, and violates the basic principle of taxation that taxpayers should owe taxes only to states when they benefit from the services those taxes pay for. In other words, nonresident taxpayers who may never set foot in Delaware over the course of the year are expected to continue paying taxes to Delaware. It's time for security to catch up to our new normal.ĭelaware’s “convenience of the employer” rule requires that taxpayers who switch from commuting into Delaware to working remotely in another state still have to pay income taxes to Delaware.

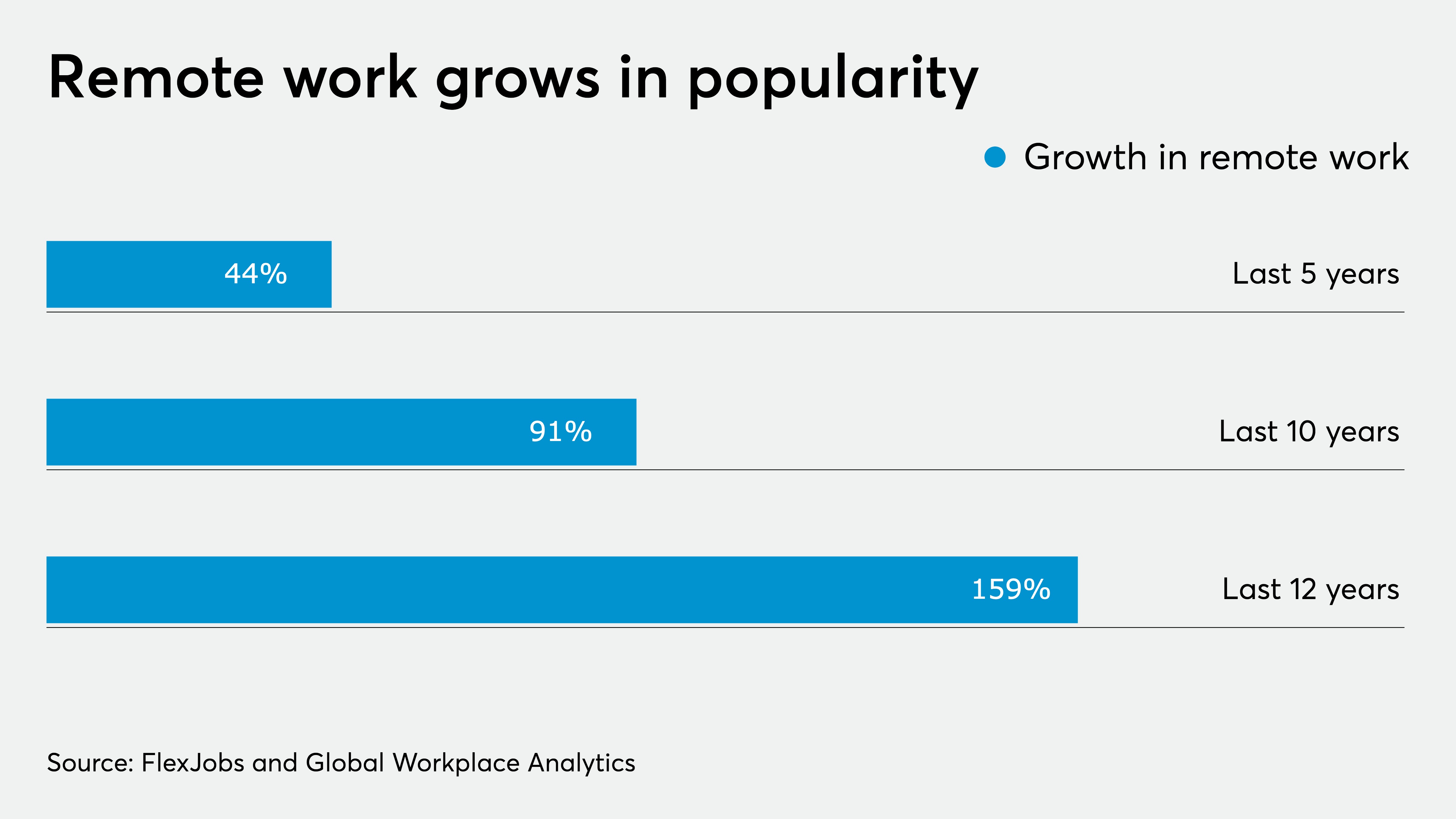

More perspective: Hybrid work is here to stay.

Despite the friendly-sounding name, “convenience of the employer” rules are anything but convenient for taxpayers affected by them. Unfortunately, they’re finding that not all states’ tax codes avoid creating unnecessary complications.Īrguably the worst state in the country in this regard is Delaware, in large part because of the state’s “convenience of the employer” rule. But with remote work here to stay, taxpayers have to grapple with the fact that while remote work offers new opportunities and detaches workers from having to live in areas just because of job opportunities, it also means changes to tax obligations. The pandemic ushered in many changes to American life, to the degree that the tax changes it brought were not initially at the forefront of taxpayers’ minds. Watch Video: Remote work tips to stay motivated and energized

0 kommentar(er)

0 kommentar(er)